How Bookmaker Margin Works: A Guide for Canadian Bettors

Have you ever wondered why the bookmaker always ends up in profit, even when you correctly predict a match outcome? The answer is simple: every betting odd already includes the bookmaker’s profit, hidden behind the technical term margin. This isn’t a trick – it’s the foundation of the betting economy. Margin is what turns random outcomes into predictable income for the operator. Even if thousands of players win, the overall odds structure ensures that the bookmaker never loses money.

Understanding this mechanism is the first step from intuitive betting to informed decision-making. When you know how and where the bookmaker earns within each odd, you start seeing the real probabilities of events – not just the ones shown on the screen.

This knowledge helps you:

- understand why odds that look fair rarely benefit the player;

- compare different platforms and choose those with lower margins;

- distinguish random wins from mathematically advantageous bets.

Research by Tadgh Hegarty and Karl Whelan shows that bookmakers don’t profit because players are wrong – they profit because the betting market is asymmetric. Companies lower the odds for underdogs and slightly adjust them for favourites. This creates a systematic profit known as the favourite–longshot bias.

What is a bookmaker’s margin?

The margin is the bookmaker’s built-in commission that turns true event probabilities into odds favourable to the operator. In essence, it’s the difference between the odds that reflect real chances and the ones offered by the bookmaker.

Example: if the true probability of a favourite’s win is 70% (fair odd 1.43), the bookmaker might offer 1.35, and for the underdog instead of 3.33 – 3.00. The difference seems small, but across hundreds of bets, it becomes a systematic advantage for the bookmaker.

Margin creates a nonlinear profit bias: the lower the probability of an outcome, the more the odds are increased. As a result, bets on longshots lose money faster than those on favourites. A study of 150,000 European football matches found that in low-competition markets, losses on underdogs can be twice as high as on favourites with the same winning probability.

In professional analysis, margin is described using several terms:

- Overround – the sum of inverse odds across all outcomes in one market. If the total exceeds 1 (100%), the excess percentage represents the bookmaker’s margin.

- Vig (or juice) – the American term for the same commission or entry fee into a bet.

The connection is simple: overround shows how much the total market probabilities exceed 100%, while vig represents how much the bookmaker earns from this imbalance.

For example, if the overround is 1.05 (or 105%), the margin is around 5%. This is the built-in markup for participating in betting – just like a broker’s fee in financial markets.

What affects the size of the margin?

Where bookmakers compete actively for clients, margins drop to a minimum – companies earn from turnover, not inflated odds. But when competition is limited, as often happens in the Canadian betting system, margins grow rapidly.

In Canada, the betting market is regulated by province, and not all regions allow many operators. For example, Ontario uses an open licensing model, meaning higher competition between platforms. As a result, the average margin on popular markets (NHL, NFL) stays around 3–4%. In provinces where only state or quasi-monopoly operators work – like Proline+ in Ontario before the reform or Loto-Québec in Quebec – the margin often exceeds 7–8%. In such cases, players get systematically lower odds compared to international markets.

In a previous article, we reviewed which local and international bookmakers are licensed in Canada.

Is it possible to find no-margin bets?

Completely avoiding margin is impossible. It’s built into the betting economy just like fees in banking or brokerage services. However, you can reduce its effect if you understand where the extra percentages go and which tools can help you reclaim part of the mathematical edge.

Technically, bypassing margin means achieving a positive expected value after all commissions and deductions. You can do this in three ways:

- finding overpriced odds (value betting);

- using arbitrage between bookmakers;

- reducing commissions through betting exchanges, bonuses, or sharp platforms.

All three methods work, but each has limitations – and as Hegarty and Whelan emphasize, the less competitive the market, the lower the chances these strategies will deliver sustainable profits.

Value betting: finding overpriced odds

The most realistic path is value betting. The idea is simple: the bettor estimates event probabilities more accurately than the bookmaker. For example, if you believe a team has a 55% chance to win and the bookmaker prices it at 50% (odds 2.00), your bet has a value of 1.10.

In practice, this requires precise forecasts, a large number of bets, and strong discipline. Bookmakers – especially retail ones – closely monitor such players, reducing their limits or blocking their accounts. Hegarty & Whelan’s study notes that these restrictions on sharp clients maintain the margin and reduce competition. In highly competitive markets like Asian handicap lines, the bias almost disappears.

To use value betting effectively, compare odds, work in low-vig markets, and manage your bankroll using the Kelly criterion. In one of our articles, we discussed the benefits of betting across multiple bookmakers.

Arbitrage: theoretically risk-free, practically limited

Arbitrage (or surebet) occurs when different bookmakers set odds so differently that you can bet on all outcomes and guarantee a profit. On paper, it’s risk-free – but in reality, it’s short-lived: lines change within minutes, and operators quickly detect such players. Moreover, arbitrage requires multiple accounts, large sums, and instant reactions.

Hegarty & Whelan note that soft bookmakers intentionally limit arbitrageurs and professionals to preserve market asymmetry. Therefore, arbitrage is suitable for occasional opportunities, not as a consistent long-term strategy.

Using betting exchanges and sharp bookmakers

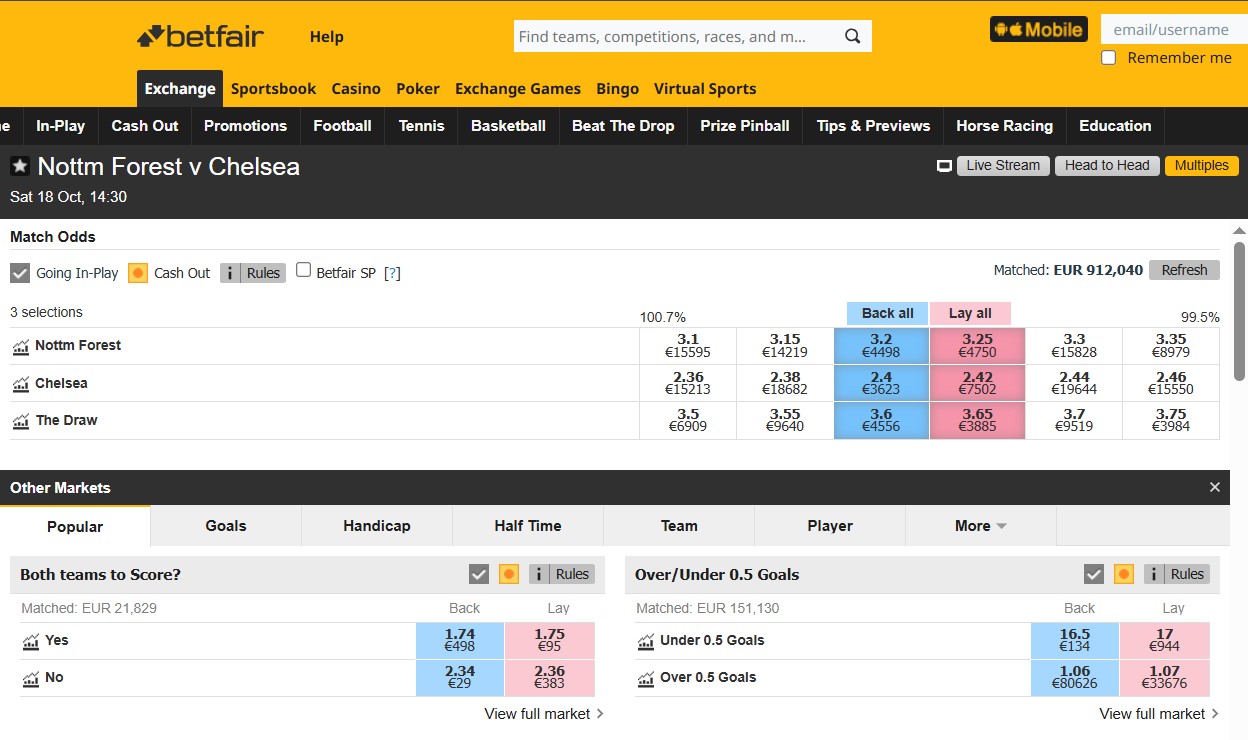

Another way to lower margin is to move where it’s already minimal. On betting exchanges (like Betfair), players bet against each other, and the platform charges only a commission – usually 2–5%. Sharp bookmakers such as Pinnacle also operate with minimal margin, earning from volume rather than juice.

In such competitive environments, as Hegarty & Whelan showed, the usual favourite–longshot bias disappears: odds reflect real probabilities more accurately, and the margin becomes nearly transparent.

Gaining an edge with matched betting

You can also partially offset margin through matched betting. The player uses welcome bonuses or free bets and covers both outcomes (back/lay), locking in a small profit. This method works but is time-limited – it’s more a short-term optimization tactic than a systematic earning strategy.

Conclusion

You can’t eliminate margin completely – it’s an inherent part of the betting market’s design. But understanding how it works allows you to choose more favourable platforms, spot overpriced odds, and avoid games with a built-in negative expectation.

Relevant news

Top 5 Tools for Smarter Sports Betting in Canada

Sports betting in Canada has become more complex. Players can now choose from hundreds of…

A Brief Guide to Sports Betting Taxes in Canada

Taxation is a concern for every player who places sports bets on a regular basis.…

What to Know About Payout Withdrawals at Canadian Sportsbooks

The rapid growth of private operators in Canada's online betting market has given players more…

How to Start Playing Fantasy Sports on Bet365

Fantasy sports have long been popular in the U.S. and Europe. Now, this format is…

Account Security for Bettors in Canada: What You Need to Know

In June 2025, researchers confirmed the largest password leak in history. Data from 16 billion…

Micro-Betting in Canada: How to Play on Bet365 and Other Platforms

Micro-betting is becoming increasingly popular among Canadian players. According to Deloitte, around 32.8% of Canadians…