Why Canadian Bettors Prefer Bet365 and Other Key Habits

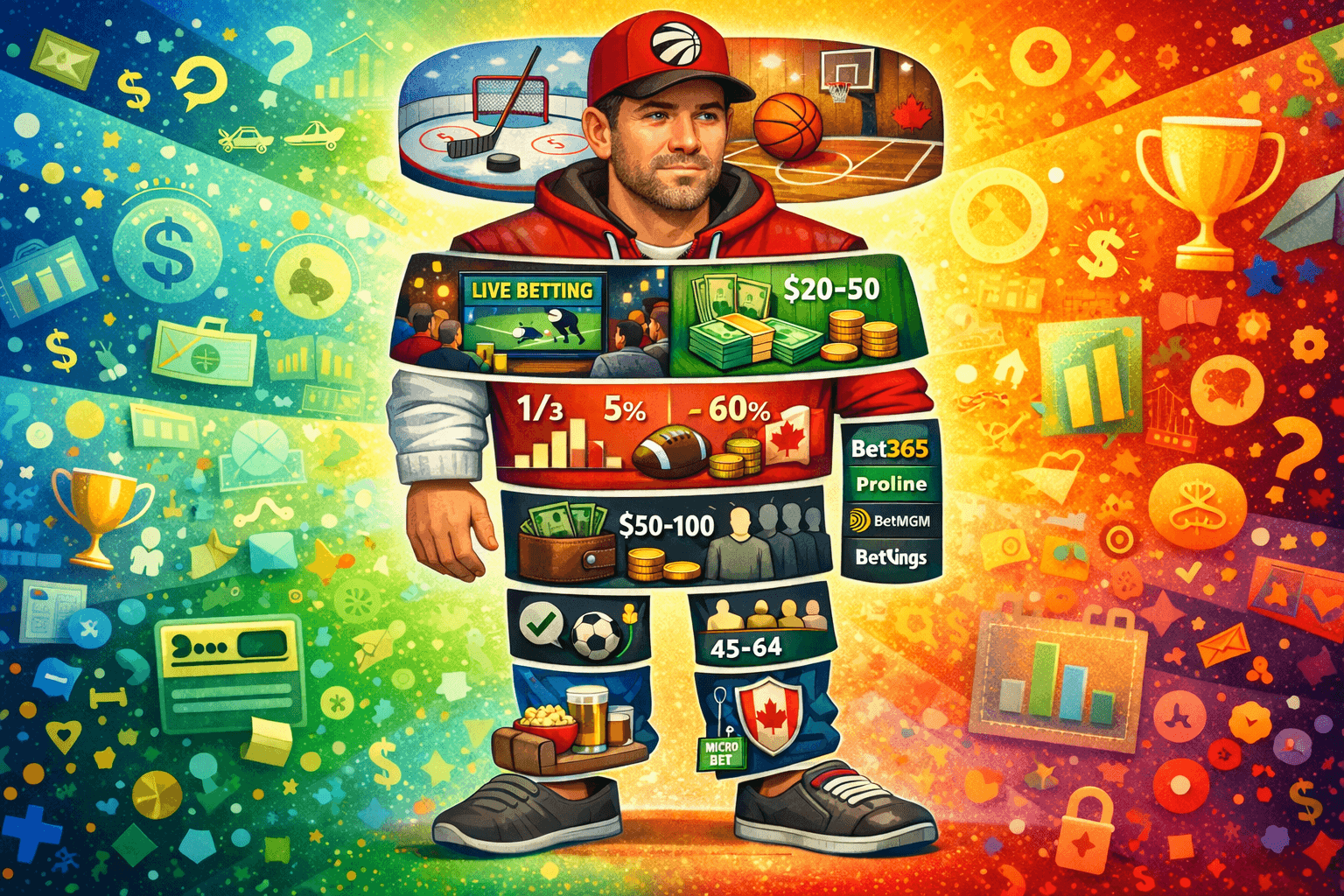

Ahead of one of the most event-packed sports years – with the Winter Olympic Games, the Super Bowl, and the FIFA World Cup – Vividata conducted a large-scale study of Canadian sports consumers and specifically examined how they place bets. The results help explain who these people are, what they bet on, and how much they spend. The Senior/Principal Analyst for EMARKETER’s Canadian business, Paul Briggs, reviewed the report in depth and outlined a detailed profile of the modern Canadian sports gambler based on a survey of tens of thousands of respondents.

How often does an average Canadian place a bet?

A Canadian odds fan is not a gambler who places bets every day. This is someone who mostly wagers on weekends, when the main games take place. About one-third of active players form the core of the market, while the majority participate moderately and from time to time.

Here is what the numbers show:

- about 1/3 place wagers weekly or more often

- 5% of them place bets daily

- more than 60% participate less frequently – a few times per month or occasionally

For context: according to Leger research, only 19% of Canadian adults placed sports bets at all over the past 12 months. This indicates that sports wagering is a minority activity rather than a mass phenomenon.

How much does a Canadian sports gambler spend?

Bet sizes in the Vividata study show a pattern of responsible play. A typical Canadian wagering fan stakes $20–50 per bet and spends around $50–100 per month. This is not a high roller, but a person for whom betting is a small form of entertainment. That is even less than the cost of a night out at a bar with friends.

“It does paint a picture of very responsible gaming overall in terms of the dollar values,” commented Paul Briggs.

What does a Canadian sports consumer bet on?

The Vividata study revealed an interesting preference breakdown:

- 30% wager in-game (during the match)

- 26% place bets on money lines (who will win)

- 20% use point spreads (with a handicap)

What this says about the gambler: the Canadian player is gradually shifting from simple “who will win” bets to more dynamic live wagers during events. At the same time, most still prefer traditional and easy-to-understand formats.

A comparison with the US based on the previously mentioned Leger survey shows that Canadians are still behind in adopting newer formats:

- 22% of Canadians have made in-play wagers vs 39% of Americans

- 15% of Canadians have tried micro bets vs 24% of Americans

The typical Canadian bettor is a conservative player. They choose simple, clear formats. At the same time, interest in live betting and wagers on non-standard events is growing. We discussed this in one of our articles.

Where does a Canadian player place bets?

Top 10 most popular online sportsbooks among Canadians according to the Vividata study:

- Bet365

- Proline

- BetMGM

- FanDuel

- DraftKings

- Betway

- Bet 999

- 888 Sport

- PlayAlberta

- Mise-o-jeu

Bet365’s leadership shows that Canadians value reputation and reliability. Bet365 has been operating since 2000, holds licenses worldwide, and is known for consistent payouts. For a gambler, confidence that winnings will be paid out is essential.

Three spots in the top 10 are held by provincial government operators (Proline, PlayAlberta, Mise-o-jeu). This is a distinct Canadian feature – bettors tend to trust state-run sportsbooks more actively, even if their odds are slightly lower and functionality is more limited. Proline has existed for over 20 years, and many Canadians began their betting journey by buying Proline tickets at kiosks. The move online was a natural step.

The presence of FanDuel, DraftKings, and BetMGM in the top five shows that US operators are successfully capturing market share through marketing efforts, partnerships with sports leagues, and media exposure. Canadians see these brands while watching NFL and NBA broadcasts.

How old is the wagering fan in Canada?

General Canadian data shows an interesting pattern:

- Youth under 24 participate in gambling less than older age groups.

- The most engaged segment is 45–64 years old.

A typical Canadian bettor is NOT a young man under 25. This is more likely someone aged 40+ with an established career and disposable income. Younger audiences are less involved, partly due to financial limitations and partly because of strong competition for their attention from platforms like TikTok and from video games.

Which sports do Canadians bet on?

According to research, in Ontario, about 29% of sports bets were placed on basketball. Soccer became the second most popular sport with around 15% of all wagers. Next come American football (13%) and hockey (9%), while baseball trails with 8% of total bets placed.

The most surprising finding: hockey is Canada’s national sport, yet it accounts for only 9% of wagers. Basketball is three times more popular.

Here are several explanations for this phenomenon:

- Game frequency. The NBA plays 82 games in the regular season, and the NHL also plays 82, but basketball is on almost every day. More games = more wagering opportunities.

- Betting simplicity. Basketball usually has many points (200+ per game), which makes it ideal for live betting and props. Hockey has 5–6 goals per game, which means fewer events to bet on.

- Global popularity. The NBA is a global league with a massive media presence. Social media coverage, influencers, and basketball culture attract younger audiences.

In addition, hockey is one of the most unpredictable sports. A single random deflection can decide the outcome. Bettors prefer sports where they feel they can calculate the result.

Why is it essential to understand the profile of the Canadian bettor?

It is crucial to understand who the typical Canadian sports gambler is to develop the industry and protect the interests of all those involved.

Sportsbooks gain product development guidelines. When it is known that most players stake less than $50, it becomes clear that the market needs micro-bets, low-entry parlays, and $5–10 wagers rather than an aggressive focus on high rollers.

Marketing strategy also requires adjustment. The typical bettor is not a twenty-year-old TikTok user but a 35–50-year-old who watches sports broadcasts on traditional TV. This means that investing in advertising during NBA and NFL games is more effective than relying only on digital channels. By the way, with the introduction of the Responsible Advertising Code, operators must promote their products more carefully. We discussed this here.

Moreover, sports preference data overturns common assumptions: basketball generates 29% of bets, three times more than hockey. Operators investing millions in NHL sponsorships based on associations between Canadian sport and hockey may be missing more profitable NBA partnership opportunities.

For regulators, the bettor profile becomes a tool for targeted rather than blanket policy. The data shows that more than 98% play responsibly with small stakes for entertainment purposes. This allows efforts to focus on identifying and protecting the 1–2% of problem players through early warning algorithms instead of imposing harsh restrictions on the entire market.

For players themselves, understanding the bettor profile is also vital. It helps them see whether they match the average pattern or belong to a niche segment. If you fall into the first category, you can confidently use most products on the market, especially those offered by provincial sportsbooks. If your preferences differ from the majority, it may be worth looking for more suitable betting options.

Relevant news

How Sportsbook Ads Are Changing the Perception of Sports Broadcasts in Canada

In 2021, Canada legalized single-event sports betting, and in 2022, Ontario opened its iGaming market…

How Technology Is Transforming Online Sports Betting in Canada

Just ten years ago, placing a bet on a match meant visiting a sportsbook website,…

The Canadian Bettor’s Calendar for 2026

2026 is set to be a busy year for sports betting fans. The main feature…

Online Betting in Canada: When Convenience Turns Into a Problem

Online betting has become firmly embedded in the habits of Canadian players. There is no…

How Betting Could Address Canada’s Sports Funding Crisis

While Canadian fans actively place bets on their favourite athletes, many athletes themselves are working…

Betting Exchanges and Sharp Sportsbooks in Canada

If you bet regularly and follow the market, you've probably noticed that odds for the…