Profitability Challenges in Ontario’s Sports Betting Sector

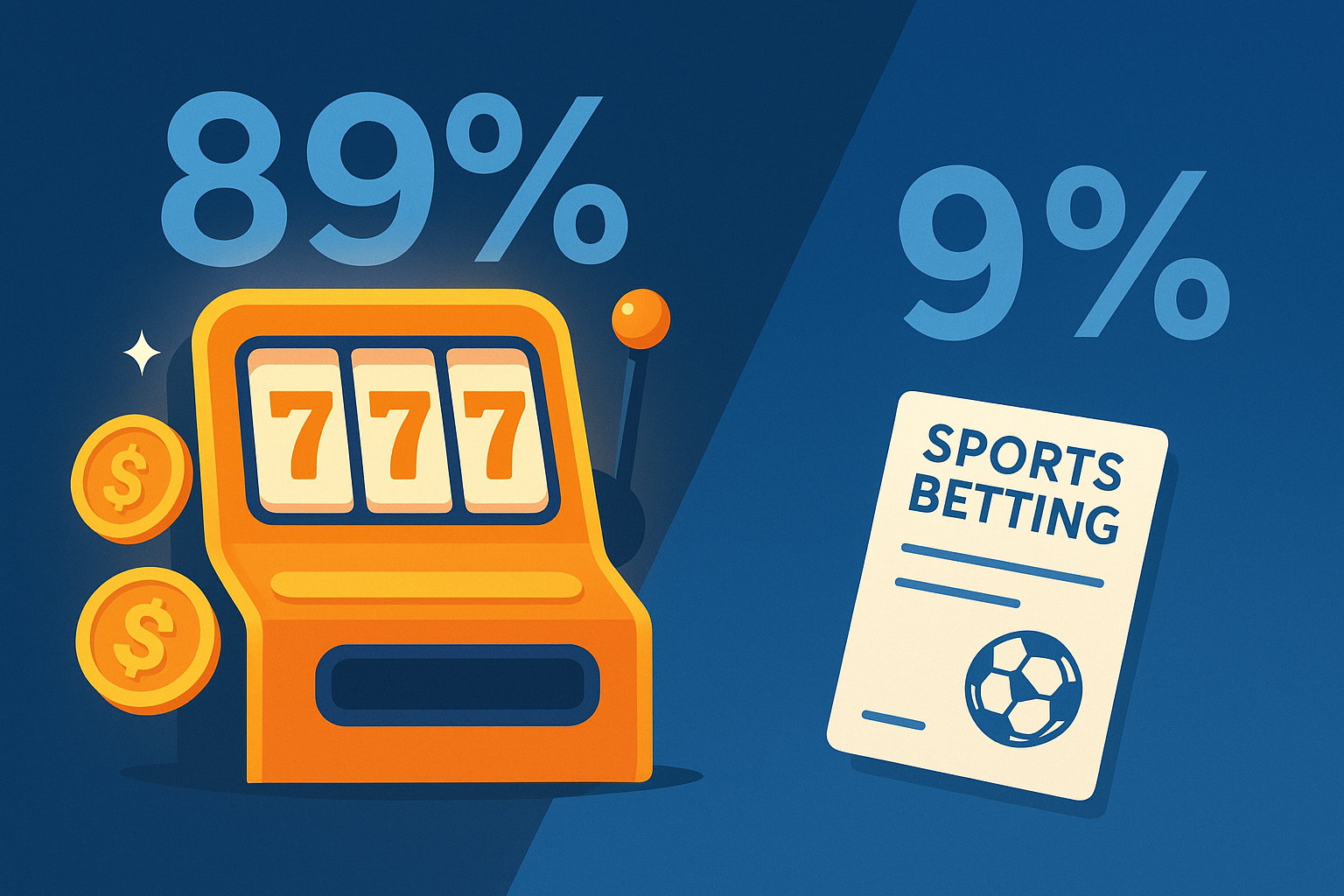

Surprisingly, in Ontario – where all the conditions for legal online wagering have been created – sportsbooks are facing losses. The latest data only confirms this troubling trend. July 2025 was especially telling. The total betting handle reached $688 million. Yet operators’ revenue amounted to a comparatively modest $52.7 million, marking the fourth decline since the beginning of the year. A market that was expected to generate steady growth is showing signs of stagnation: annual turnover grew by just 2.5%, while sports betting’s share compared to casinos and other forms of gambling collapsed to a record low of 9%. In this article, we’ll look into the reasons behind this development.

Casinos: the dominant segment of the gambling market

Online casinos are currently the main source of revenue for operators. iGaming Ontario has registered 87 gaming sites, 35 of which also offer sports wagering. Almost all of these operators feature online casinos on their platforms. Interestingly, around 45 of them are pure casino sites without betting options. Online casinos account for 89% of total gambling revenue in the region – $6.737 billion. Gross profit reached $252.3 million, rising 37.4% year-over-year. Meanwhile, sports wagering brought in just $688 million – the lowest figure in the past eleven months.

This data doesn’t just state the obvious; it points to a profound structural shift across Ontario’s iGaming industry. The dominance of online casinos against a backdrop of stagnating sports betting reflects fundamental economic and behavioural factors, which we’ll explore further.

Why sports betting profitability is falling in Ontario

The July 2025 figures are symptoms of systemic problems facing licensed operators in Ontario.

The challenges can be explained by several factors:

- Competition from the grey market. Despite restrictions, unlicensed platforms continue to operate actively, enjoying significant advantages. They are not bound by AGCO regulations, allowing them to offer a wider variety of bets or extremely high limits to attract big players. Without paying high taxes and licensing fees, they can also provide better odds, drawing in bettors looking for value. As a result, they divert a considerable audience away from legal bookmakers.

- Strict advertising rules. AGCO’s ban on promoting bonuses puts local sportsbooks at a clear disadvantage. Their marketing campaigns appear duller and less persuasive. Meanwhile, illegal operators freely use aggressive and appealing messages. As a result, licensed sportsbooks are forced to spend enormous amounts on marketing just to stand out from the crowd, yet it brings little return. In one of our articles, we discussed the marketing strategies employed in the betting industry.

- High operating expenses. Legal status brings a triple financial burden. First, direct costs: expensive licenses and some of the highest gross gaming revenue taxes in the world. Second, compliance costs: maintaining systems for identity verification, responsible gambling, and anti-money laundering. Third, as already noted, the massive marketing budgets required to operate under restrictions.

- Seasonality. Unlike online casinos, which generate stable revenue 24/7/365, sports wagering is volatile. Periods without major tournaments or playoff finals inevitably lead to declines in activity and revenue. Operator profit depends not only on betting volume but also on unpredictable outcomes. A few underdog wins at long odds can wipe out an entire month’s margin overnight. Online casinos, by contrast, carry no such risk, as the math always favours the house.

All of this creates a vicious cycle. Bookmakers spend heavily to attract customers in a hyper-competitive and tightly regulated environment, but their ability to earn profits is limited by seasonality, structural risks, and high operating costs.

The future of online sports betting in Ontario

This naturally raises the question: what lies ahead for sports wagering? Based on current data, several scenarios are likely.

First, a wave of consolidation is inevitable. A market where 50 operators share a limited audience is economically unsustainable. The current situation, with even major players reporting declining revenues, will speed up natural selection. Smaller and mid-sized brands without strong infrastructure or recognizable names will either exit or be acquired by industry giants. FanDuel, DraftKings, and BetMGM can afford to operate at a loss to preserve market share.

Second, a shift away from traditional marketing and business models. Spending on sign-up offers no longer pays off. Bookmakers will have to prioritize quality over quantity – focusing on retaining loyal, profitable customers. This could mean reward programs and personalized offers for existing users.

Third, a change in how betting is positioned. Since online casinos continue to grow steadily, most operators will treat sports wagering primarily as a gateway product. Bettors will be guided toward casino games, where margins are far higher. Sports betting risks becoming merely an auxiliary product in the portfolios of large iGaming groups.

Finally, potential regulatory easing. Four consecutive months of declining key indicators send a strong signal not only to bookmakers but also to the regulator (AGCO). If the trend persists, tax revenues and the sustainability of the legal market will be at risk. This may push AGCO to reconsider some of its toughest restrictions, particularly around advertising and promotions. In another article, we examined how advertising policies in betting are currently implemented.

Thus, the July 2025 slump is not a random anomaly but a turning point. The phase of rapid growth for Ontario’s betting market is over. It is now entering a maturity stage defined by new promotional strategies, consolidation, and a strategic reshuffling of influence. From now on, survival for operators will depend less on customer acquisition spend and more on their ability to maximize value from each player. We’ll continue monitoring the evolution of betting in Ontario and Canada to keep you updated.

Relevant news

SuperPot in Ontario: Innovation in Gambling or a Trap for Bettors?

Imagine this: you've just placed a bet on a match in your bookmaker's mobile app,…

Summer Slowdown in Canadian Betting: How Sportsbooks Adapt

The summer months are marked by a noticeable drop in user activity in online betting.…

The Influence of Match-Fixing on Legal Betting in Canada

In Canada, where betting is legal and well-regulated, match-fixing remains a grey area. There are…

How Online Betting is Reshaping Ontario’s Horse Racing Industry

Ontario stands as one of Canada's major hubs for horse racing, supporting around 23,000 jobs…

The Impact of Betting Operator Diversity in Ontario on Player Habits

The online betting market in Ontario has experienced significant growth since the sector was legalized…

Which Legal Sportsbook Platforms Are Available in Canada: Bet365, 22Bet, 20Bet, and Others

Sports betting is incredibly popular in Canada, with a generally lenient attitude toward it. However,…